Traditional retail banks face wide-ranging challenges when it comes to building meaningful relationships with customers and reaching new audiences.

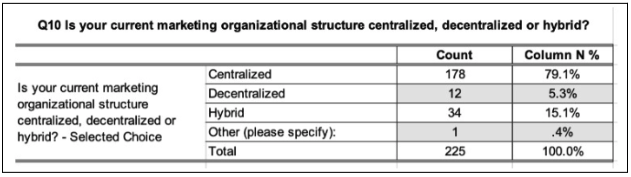

With efficiency gains a top priority, it’s no longer cost-effective for most banks to sustain multiple regional marketing departments. Indeed, research from the American Bankers Association revealed that only 5% of institutions have a decentralized marketing structure, with the vast majority handing responsibility to a single, centralized marketing unit.

This strategy might yield cost savings. But it makes it much harder to deliver localized messaging to existing and potential customers in specific geographies.

And the less “local” your marketing feels, the more disengaged your audience will become.

But it doesn’t have to be like that. High-quality content marketing for banks can allow you to build a genuine connection with consumers, helping you encourage loyalty, maximize lifetime value, and expand your customer base.

In this article, we’re going to discuss why content marketing matters for banks and share four of our favorite banking-specific best practices:

- Use accessible language to discuss complex, intimidating financial topics

- Invest resources to keep existing content up to date

- Help audiences visualize their financial goals with interactive content

- Define audience niches and use them to create more “personal” content

Why Does Content Marketing Matter for Banks?

Gone are the days when consumers would simply sign up with their local bank and stick with them for life.

Today, banking customers are practically overwhelmed by choice. The growth of digital challenger banks and FinTech solutions means there’s no need to choose a traditional retail bank — or even to visit a physical banking branch at all.

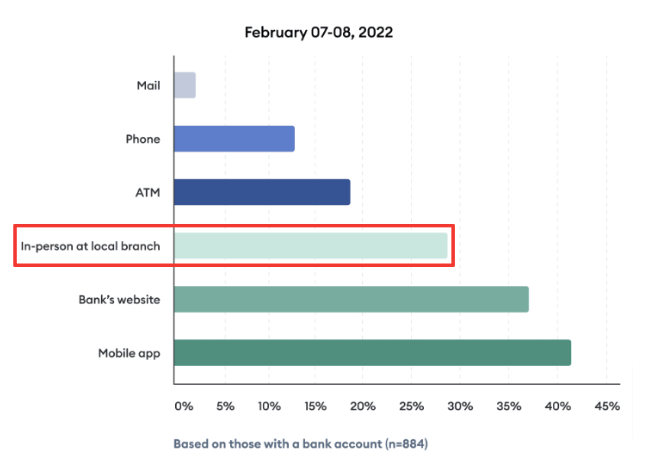

Consumers appear to relish this freedom, with research from Entrust revealing that 88% prefer to bank online, while 72% would switch from traditional banks to branchless online services.

Unsurprisingly, younger audiences are most eager to leverage native digital banking, with 77% of millennials saying they would move to a digital-only banking provider.

So is it game, set, and match to the branchless banks?

Certainly not. Fact is, customers still value a physical bank, with Ipsos-Forbes Advisor research revealing that roughly one-third of Americans prefer to bank in-person at their local branch.

Paul McAdam, senior director of banking and payments intelligence at J.D. Power, told Forbes that consumers tend to be more satisfied with the advice and support they receive in person, because it’s personalized.

What’s more, he explained that consumers who use branches report greater familiarity with the bank’s fee structures and policies.

In other words: there’s still a big opportunity for traditional banks. Not only can they offer a more customized experience in-person, but they can bring that strategy to their online products and services as well.

However, they must nail their marketing to remain competitive in a digital-first world. So, let’s discuss how banks can do just that.

4 Content Marketing Best Practices for Banks

1. Discuss Complex Topics in Accessible Terms

Finance-related topics feel confusing, inaccessible, and overwhelming to many consumers — partly because many lack a basic understanding of financial terminology.

Research from Ipsos found that approximately one third of Americans are not financially literate, with the average US citizen rating themselves as a 6.2/10 for financial literacy.

However, roughly one-quarter of those who believe they are financially literate were found not to be when quizzed about common financial concepts, including:

- Risk diversification

- Inflation

- Compounding interest

What’s more, separate research from the FINRA Foundation revealed that 63% of non-financially literate Americans feel anxious when thinking about personal finances.

On the face of things, this feels like a big problem for traditional banks; a significant proportion of your audience doesn’t understand what you’re talking about, and the subject matter makes them feel anxious.

But it’s also an opportunity. If you can discuss complex — and potentially anxiety-inducing — topics in accessible language, you can empower your customers and pull ahead of the competition.

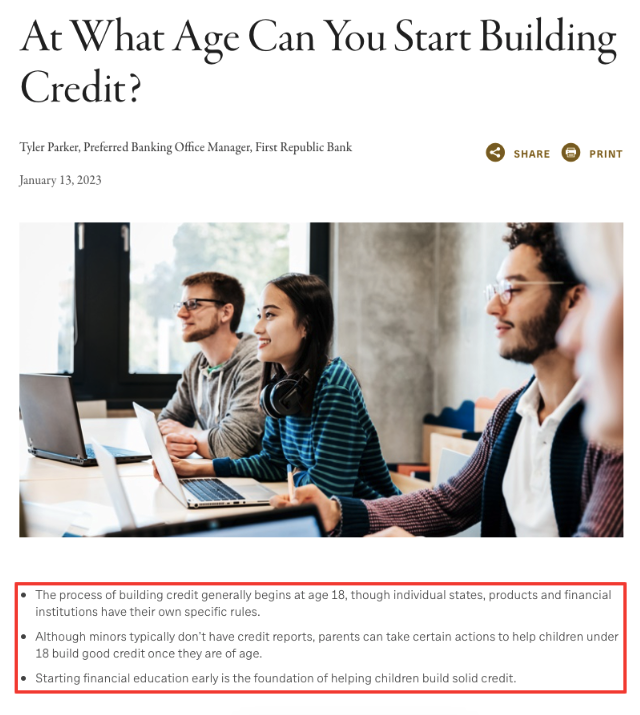

Full service bank and wealth management company First Republic shows us how content marketing for banks can make financial subjects feel a lot less intimidating. Over time, they’ve developed a resource center packed with easy-to-understand, consumer-centric financial advice and information on topics like:

- Building credit

- Avoiding financial exploitation

- Transferring money between accounts

- Understanding bank statements

- Writing a check

Each article starts with a series of succinct bullet points that break down the main topic into easily digestible portions:

This is a smart way to structure your financial content: include the most important information first, then use the rest of the article to provide further context.

First Republic’s content is also easy to navigate, with subheadings helping readers find the most pertinent information:

This user-centric approach means that visitors only spend their time reading relevant content. Which, in turn, makes them more likely to view First Republic as a reliable, trusted resource.

That’s good news for the bank, because consumers rank trustworthiness and reliability as the most important factors for building relationships with brands — even ahead of product quality and convenience.

Key Actions

- Speak to your customer support and branch teams: what are the most common questions they get asked by existing and would-be customers?

- Use those questions as inspiration for content in your own online resource center for user-friendly financial information.

- Structure your content so it’s easy to scan and pick out key information; bullet points and subheadings are your best friend here.

2. Invest Time to Keep Content Up to Date

In the fast-paced world of finance, information that’s accurate today could be totally outdated tomorrow.

For that reason, if you’re going to commit to content marketing for banks, it’s vital that you invest time and resources into keeping content relevant and up to date.

To demonstrate the importance of this point, let’s take a look at an article from Citizens Bank on how a 23-year-old art teacher makes her budget work each month. Within the first couple paragraphs, there are multiple statistics that could quickly become outdated:

If any of those stats are glaringly wrong, it undermines the reader’s confidence in the entire article — in which case it’s doing Citizens Bank more harm than good.

But it’s not just about statistics. There are various elements of your content that might require regular updates, including:

- Interest rates

- Terms and conditions

- Specific products

Keeping content up to date requires constant attention, which can detract from your ability to create new assets.

However, it’s not all bad news, with research revealing that 21% of marketers believe updating existing content is the most effective way to generate engagement, leads, and conversions.

Key Actions

- Audit your content marketing assets and list any that contain time-specific information (like statistics and product information).

- Rank information by the frequency with which it should be updated. Will a statistic still be relevant after two years? Or does it need refreshing every month?

- Add content updates to your content creation workflow, ensuring you have sufficient time and resources to keep each article up to date.

3. Create Interactive Content to Visualize Financial Goals

We’ve already noted how financial topics can be challenging for consumers to understand.

Using simple language and user-friendly content design is one solution to this problem. But it’s important to remember that there are lots of different learning styles; some of us prefer to learn new information by reading or watching videos, whereas others are more hands-on.

For that reason, it pays to invest in interactive content that helps your audience find their own answers to common questions and visualize their financial goals.

Primeway Federal Credit Union use interactivity to supplement their in-depth guides on financial planning, creating a more personalized user experience:

Interactive content isn’t just a nice-to-have. It delivers real results.

Magna Global compared the performance of interactive ads against “regular” adverts and discovered that adding interactivity boosts content recall and brand familiarity. What’s more, 75% of people who engaged with the interactive content went on to perform an action, including:

- Looking for a product (64% of respondents)

- Researching deals (63%)

- Searching for more information online (59%)

Key Actions

- From the common questions you identified after speaking to branch and customer support teams, select those that would make the best interactive content (such as the user searching for advice based on their specific savings goals).

- Create a calculator (or some other form of interactive content) that helps answer those questions.

- Add a call to action to contact your customer support team for more personalized advice, helping to convert visitors into leads.

4. Tailor Content to Specific Audiences

Most traditional banks cater to a wide range of customers, from parents opening their child’s first account, to students, professionals, retirees, and more.

It can be tempting for marketers to create content targeting the widest possible audience. The more people an article appeals to, the more visitors you’ll attract, right?

In reality, it rarely works like that. Fact is, consumers increasingly demand content that feels personalized.

Research from McKinsey & Company revealed that 71% of consumers expect companies to deliver personalized interactions, with 76% feeling frustrated when this doesn’t happen.

For content to feel personal, it must appeal to a specific niche (the tighter the niche, the more personal the content).

This might mean less traffic potential, but it also means your content will be more meaningful. That’s a big deal among younger audiences, with Google research revealing that 65% of Gen-Zers agree content that’s personally relevant to them is more important than the content that lots of other people talk about.

What does this mean for content marketing for banks?

That you should take the time to clearly define different audience segments. This way, you can group relevant content into specific categories, making it easier for visitors to find information that’s most useful to them.

Regions Bank understand the value of this approach, segmenting their audience by “life stages.”

Not only does this strategy make your content hub easier to navigate, but it also helps you create more customer-centric content by forcing you to consider exactly who you’re writing for.

Key Actions

- Define all the different audiences you serve. The tighter you “niche down,” the more personal your content will feel. For instance, new parents will likely search for different information than parents with teenage kids.

- Use your newly defined audiences to categorize existing content, updating articles and guides where necessary to make it more personalized.

- Decide the target audience of each piece of content before you start writing.

Content marketing for banks requires a lot of time and effort. Don’t have the resources to do it all yourself? We can help!

Get in touch with Content Conquered today to see how we can help you engage your audience and create more targeted content.